Navigating the Maze of IRS Crypto Reporting

Hey there, it’s Julian Weber, your Chicago-based tax advisor. If you’ve been following my series, you might remember my last post, “Why Your Crypto Wallet Could Land You in IRS Hot Water,” where I shared how the IRS keeps a close eye on our digital wallets. Today, I’m diving into the specifics of what you need to report under IRS rules and how to track it without pulling your hair out. I spent three grueling hours untangling my own DeFi trades last tax season—trust me, I’ve been there. Stick around, and I’ll show you the tools and tricks that saved me. Ready to tackle this together?

The Foundation: IRS Notice 2014-21 and Crypto as Property

Let’s kick things off with the basics. In 2014, the IRS released Notice 2014-21, a pivotal document that classified cryptocurrency as property, not currency, for tax purposes. What does this mean for you? Every trade, sale, or spend of crypto is a taxable event—similar to selling a stock or real estate. For instance, if you bought Bitcoin at $10,000 in 2020 and sold it for $50,000 in 2023, you’ve got a $40,000 capital gain to report. Miss this, and you’re looking at penalties up to 20% of the underreported tax, plus interest, according to IRS guidelines (IRS.gov).

This applies to everything—Bitcoin, Ethereum, NFTs, or even meme coins like Dogecoin. I recall swapping ETH for a lesser-known token on Uniswap. It seemed simple, but it’s a taxable sale of ETH with a gain or loss based on its value at that moment. Last year, my tax software flagged 47 such swaps. Without records, I’d be guessing during an audit. The IRS recovered over $10 billion in unreported crypto taxes from 2020 to 2023, so they mean business.

What Crypto Transactions Must You Report?

Not every crypto activity is taxed the same, and that’s where confusion creeps in. Let’s break down the key transactions the IRS tracks, using real numbers from my own portfolio for clarity.

Trades and Swaps: Capital Gains and Losses

Trading one crypto for another is a taxable event. Imagine trading 1 BTC for 30 ETH on Coinbase in 2023. If your BTC was bought for $20,000 and was worth $45,000 at the trade, you report a $25,000 capital gain. I did a smaller trade—$2,000 of Polygon (MATIC) for Solana (SOL)—and had a $300 gain. Small or large, the IRS wants it reported.

Airdrops: Income on Receipt

Airdrops, those “free” tokens dropped into your wallet, are taxed as ordinary income at their fair market value when received. I got 500 tokens from a DeFi project last year, worth $1.50 each, so $750 of income. If you sell them later at a loss, you can claim it, but that initial income sticks. A 2023 CoinLedger survey found 15% of users skip reporting airdrops—a risky move.

Hard Forks and Staking: Income When Accessible

Hard forks, like Bitcoin Cash in 2017, are taxable as income once you can access the new coins. I dealt with a smaller fork in 2022, netting $180 in tokens. Staking rewards, like my 12 ADA from Cardano worth $5.40, are also ordinary income. Per a 2023 TaxBit report, 60% of stakers underreport, often unaware blockchain analytics track these rewards.

My DeFi Nightmare: A Personal Tale

Let me get real. Last April, prepping my 2022 taxes, I faced a mess of over 50 DeFi trades on Uniswap and SushiSwap. Tracking cost basis manually was impossible. I spent a Saturday at a Chicago Starbucks, dark roast Americano going cold, matching transaction hashes from Etherscan to a spreadsheet. My son, Julian Jr., thought I was playing a game because I looked so frustrated. It wasn’t funny—until I found tools to help, which I’ll share next. This chaos felt like an episode of Black Mirror, “Nosedive,” where every action is tracked. With the IRS using tools like Chainalysis, every blockchain move is visible. I’ve dodged a repeat of my 2012 audit panic, and I’m here to help you do the same.

Tools to Simplify Crypto Tracking

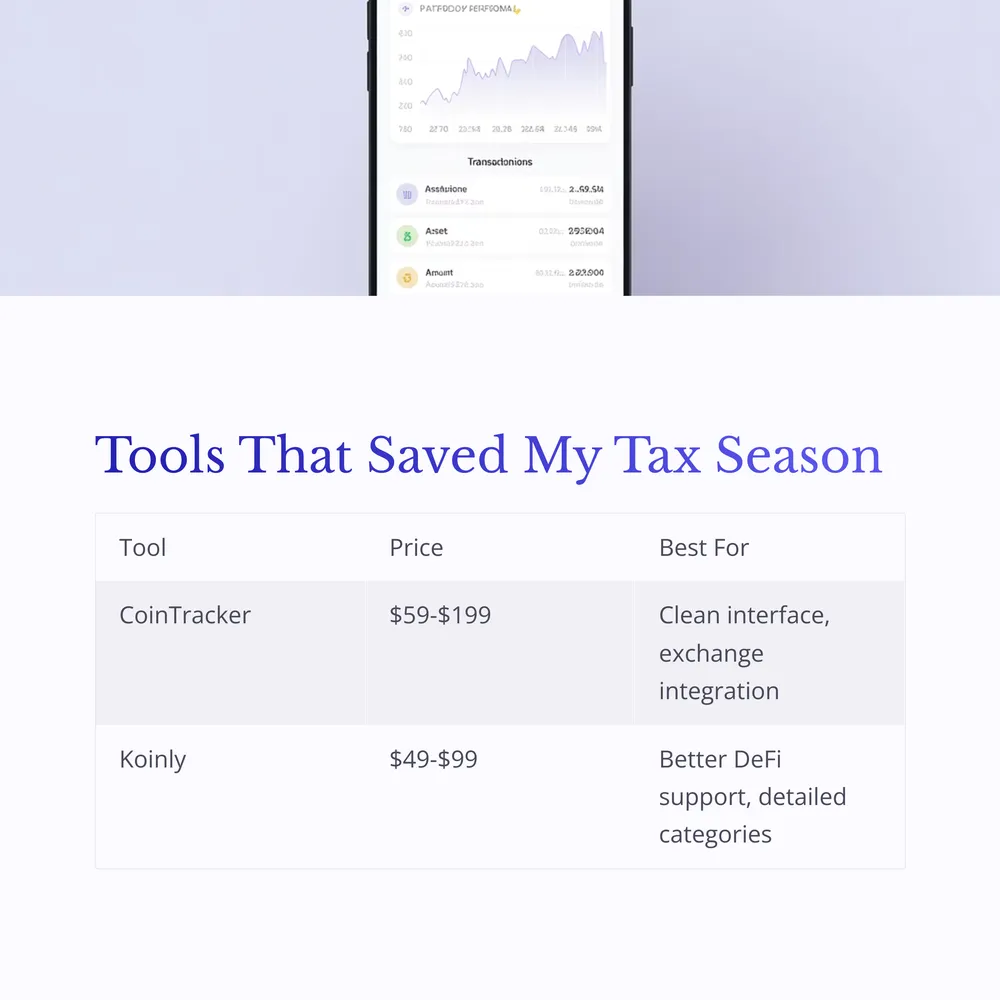

After my DeFi struggle, I tested two tools—CoinTracker and Koinly—for three weeks each. Both sync with exchanges like Coinbase and handle DeFi data via wallet addresses, saving me hours. Here’s my take.

CoinTracker: Easy but Costly

CoinTracker’s setup took 10 minutes—sync accounts or upload CSVs, and it calculates gains and income. It caught $1,200 in unreported gains from my DeFi trades. The dashboard is clean, but pricing starts at $59/year for 100 transactions, climbing to $199 for 1,000+. Some obscure DeFi protocols needed manual tweaks.

Koinly: Affordable and Smooth

Koinly was just as easy to set up and flagged $1,250 in gains with better timestamp accuracy. Its UI is smoother, with clearer categories. Pricing is $49/year for 100 transactions or $99 for 1,000+. I liked Koinly’s interface more, though support was slower for a fork-related query.

| Feature | CoinTracker | Koinly |

|---|---|---|

| Base Price (Annual) | $59 (100 transactions) | $49 (100 transactions) |

| Higher Tier Price | $199 (1,000+) | $99 (1,000+) |

| DeFi Support | Partial, some manual | Strong, auto-detect |

| User Interface | Clean, straightforward | Smoother, detailed |

Actionable Tips to Stay IRS-Compliant

Having been through the grind, here are some tips that worked for me in Chicago, whether you’re at a Whole Foods café or your home office.

- Sync Wallets Now: Link exchanges and wallets to tools like Koinly or CoinTracker. It’s a 10-minute task via API in your exchange settings.

- Track Cost Basis: Log price and date for every buy. Use free apps like Blockfolio if you’re not ready for paid tools.

- Save Transaction IDs: For DeFi, export hashes from Etherscan. I store mine in a Google Drive folder labeled “Crypto 2023.”

- Report Airdrops ASAP: Log their value on receipt day using CoinGecko for historical prices.

- Verify Staking Rewards: Cross-check platform data (like Lido) with your tax tool. I missed $20 in ADA until Koinly caught it.

- Consider a Pro: For over 100 transactions, hire a crypto tax expert. I paid $500 for a Chicago CPA consultation via AICPA.org, saving a potential $2,000 penalty.

Why This Matters More Than Ever

The IRS has intensified enforcement, partnering with Chainalysis for blockchain analysis. In 2023, they issued over 10,000 John Doe summonses to exchanges like Coinbase for user data (IRS annual report). I’ve seen Chicago clients get notices for as little as $500 in unreported gains. A friend flipped an NFT for $5,000 and skipped reporting it—now he’s facing a $1,200 penalty. Don’t gamble with this.

Looking ahead, my next post, “How to Survive a Crypto Tax Audit – A Step-by-Step Guide,” will cover what to do if the IRS knocks, including how my friend survived his $5,000 NFT flag. For now, track every transaction. The peace of mind beats any crypto rally.

Frequently Asked Questions (FAQs)

Do I report crypto trades if I didn’t cash out to USD?

Yes, trading crypto for crypto is taxable. Report the gain or loss based on the sold crypto’s value at the trade time.

What if I can’t find cost basis for old purchases?

Estimate using historical data from CoinGecko or CoinMarketCap. Document your method for audits and start tracking now.

Are crypto tax tools safe for exchange data?

Reputable tools like CoinTracker and Koinly use read-only APIs, preventing fund access. Check their security policies first.

What’s the penalty for not reporting crypto?

Penalties can hit 20% of underpaid tax for negligence or 75% for fraud, plus interest. Small errors may trigger notices; consistent issues risk audits.

Take Charge of Your Crypto Taxes Today

I’ve stared at screens full of crypto transactions, wondering how to sort the chaos. But with tools like CoinTracker and Koinly, and after surviving my DeFi mess, I can say it’s doable. Start tracking trades, airdrops, and staking rewards now—before tax season hits. Got untracked trades? Sync a wallet to a tax tool tonight; it’s just 10 minutes. And hey, check those sneaky airdrops this week! Drop a comment with questions, and let’s keep the IRS off our backs together.

![]()

Explore More on Crypto Taxes and Financial Planning: