The Hidden IRS Threat in Your Crypto Wallet

Picture this: a cold Chicago evening, the wind howling outside, and I’m sipping my dark roast Americano at the kitchen table. I’m checking my Coinbase account, feeling pretty good about a 12% gain on my $5,000 Bitcoin investment and $1,200 from some Ethereum trades. I’m like a toned-down Wolf of Wall Street, riding the digital currency wave—until a tax forum alert stops me cold. “IRS targeting crypto non-filers, penalties up to $100,000.” My heart sinks. I hadn’t reported a thing. Was I next?

As a Chicago-based tax advisor with over a decade of experience—and a personal IRS audit scare in 2012 that left me battling panic—I know how fast financial slip-ups can turn into disasters. Crypto is a different animal, though. The IRS is crystal clear: it’s taxable, trackable, and ignoring it could mean serious trouble. In this post, I’m breaking down why your crypto wallet might land you in hot water, covering rules on capital gains, staking, and NFTs, plus giving you practical tips to stay compliant. Stick with me—because an IRS notice is the last thing you want.

The IRS Has Eyes on Your Crypto Transactions

Here’s the deal: the IRS treats cryptocurrency as property, not cash. Every trade, sale, or swap is a taxable event. Just last month, over deep-dish pizza at Lou Malnati’s, my CPA buddy Marcus Chen told me about a client who owed $24,000 in back taxes on unreported 2021 Bitcoin gains. “Julian, the IRS is pulling data from Coinbase and Binance,” he said. “They’ve recovered over $10 billion in crypto taxes since 2019, per their reports.” That’s billion with a B—they’re not messing around.

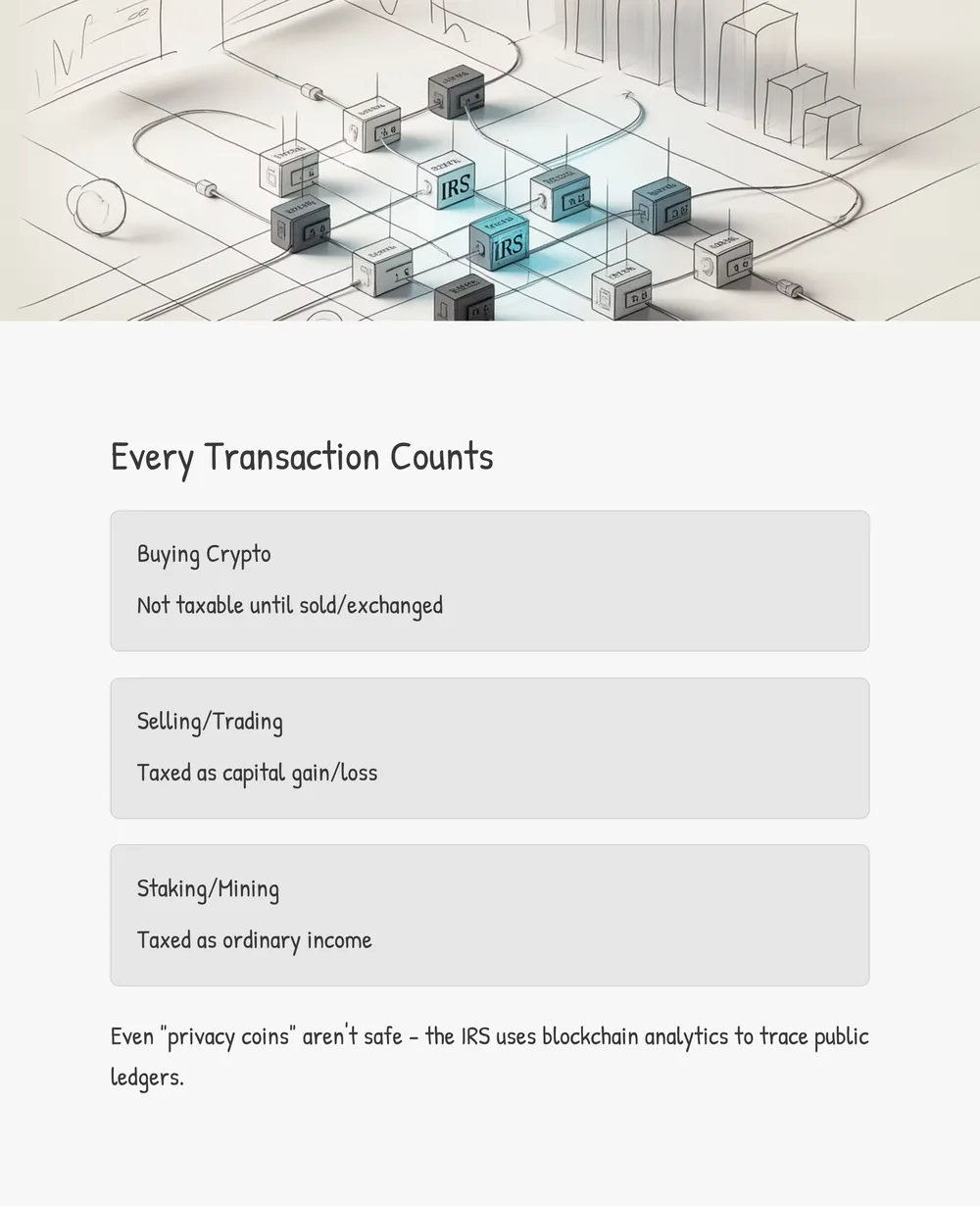

Let’s get specific. Buy 1 BTC at $20,000 in January 2022 and sell at $30,000 in December? That’s a $10,000 capital gain, taxed at short-term rates (up to 37%) if held under a year, or long-term (up to 20%) if longer, based on your income. Swapping BTC for ETH on Uniswap counts too—it’s like selling one to buy another, taxed on the market value at the swap. Even “privacy coins” like Monero aren’t safe; the IRS uses blockchain analytics to trace public ledgers.

Staking or mining? That’s income. Earn 5% APY on Cardano through Lido Finance—say, $500 in ADA over six months—and it’s taxed as ordinary income at your rate. A client of mine, a techie from Lincoln Park, mined $3,000 in Ethereum on his gaming rig last year. He thought it was “off-grid.” The IRS didn’t, hitting him with a $1,200 penalty plus interest after tracing his wallet. Nothing’s hidden.

NFTs? Same story. Sell a Bored Ape Yacht Club NFT bought for 2 ETH ($4,000) at 5 ETH ($10,000), and you’ve got a $6,000 taxable gain. Even airdrops or gifted NFTs are taxed on their value when received. Since 2020, Form 1040 asks upfront: “Did you receive, sell, exchange, or dispose of virtual currency?” Lie with a “No,” and you’re begging for an audit. IRS data shows over 8.7 million taxpayers reported crypto in 2022, with non-compliance audits up 50% since 2021.

My Own Crypto Tax Close Call

I nearly got burned myself. In 2022, I made $800 yield farming stablecoins on Aave. Felt like free money—until I realized I hadn’t logged a single transaction. My son, Julian Jr., was playing nearby as I scrambled through my MetaMask history, stressing over gas fees. With my JD from the University of Chicago and years of tax work, I caught it in time, filed an amended return, and paid $240 in taxes. But it hit me: if I can mess up, what about you?

Digging into IRS Notice 2014-21, which labels crypto as property, I learned about their partnerships with firms like Chainalysis for tracking. It’s like *Black Mirror*’s “Nosedive”—every digital move is watched and could cost you. The IRS’s Operation Hidden Treasure, started in 2021, targets crypto evasion with data from exchanges via summons like the 2016 Coinbase one. If your filings don’t match your wallet, expect trouble.

Why Crypto Compliance Is Non-Negotiable

Think the IRS won’t notice your $2,000 Dogecoin stash? Think again. Their AI-driven tools flag even small discrepancies. A 2023 Treasury report says 80% of crypto audits start with automated detection. Penalties hurt: 20% on unpaid taxes for negligence, plus 5% annual interest. Willful evasion? That’s a felony under 26 U.S.C. § 7201, with fines up to $100,000 and jail time.

I’ve seen it firsthand in Chicago. A freelancer client cashed out $15,000 in Bitcoin for rent, thinking it “didn’t count.” The IRS caught it via a 1099-K from his exchange, slapped him with a $3,000 penalty and $450 in interest. It crushed him—money for his kid’s college fund, gone. It’s not just cash; it’s the stress. I’ve lived it during my 2012 audit, and trust me, you don’t want that nightmare.

Navigating Crypto Tax Rules Like a Pro

So, how do you dodge the IRS heat? First, know what’s taxable. Capital gains hit on sales or trades—subtract your cost basis (purchase price plus fees) from the sale price. I bought 0.5 BTC for $10,000 (with a $50 Coinbase fee) and sold for $15,000; my $4,950 gain is taxed. Staking, mining, or airdrops? Report as income at fair market value when received. A $200 UNI airdrop on September 1, 2023, at $5 per token means $200 income, even if you hold.

Second, track everything. The IRS wants dates, amounts, USD values, and transaction types. I learned this reconstructing DeFi trades—without records, you’re sunk in an audit. Third, use the right forms: capital gains on Schedule D and Form 8949, income on Schedule 1. Stay tuned for my next post, where I’ll dive into tools like CoinTracker to simplify this.

| Transaction Type | Taxable? | IRS Treatment | Example |

|---|---|---|---|

| Buying Crypto | No | Not taxable until sold/exchanged | Buy 1 BTC for $30,000—report later |

| Selling Crypto | Yes (Capital Gain/Loss) | Taxed on gain/loss vs. cost basis | Sell 1 BTC for $35,000—$5,000 gain |

| Trading Crypto (BTC to ETH) | Yes (Capital Gain/Loss) | Taxed as sale of one for another | Swap 1 BTC for ETH—report gain/loss |

| Staking/Mining Income | Yes (Ordinary Income) | Taxed at value on receipt | Earn $500 ADA—report as income |

| NFT Sale | Yes (Capital Gain/Loss) | Taxed on gain/loss vs. cost basis | Sell NFT for $10,000—report gain |

6 Actionable Tips to Keep the IRS at Bay

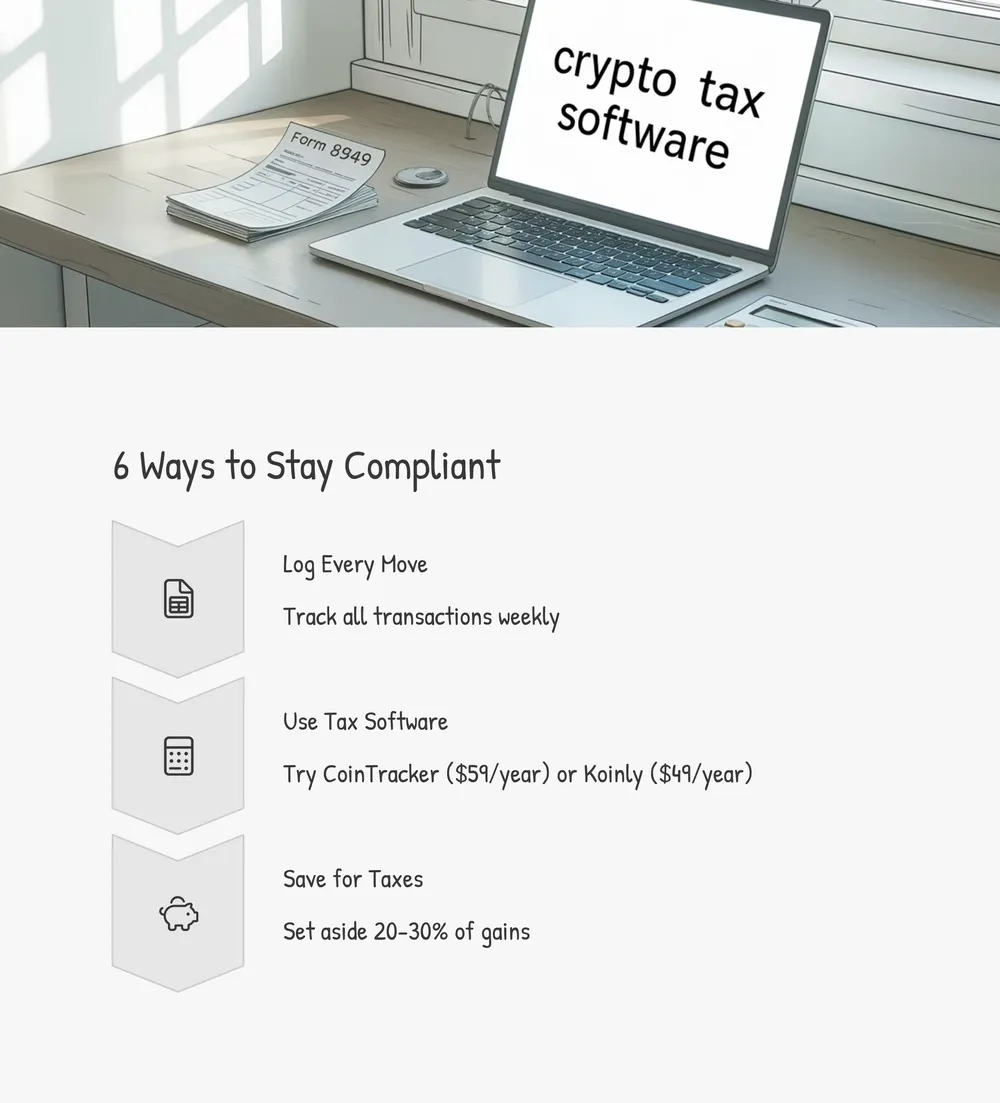

Let’s make this practical. Here are six beginner-friendly tips from my tax advisory experience—and my own near-misses—to protect your crypto wallet from IRS scrutiny:

- Log Every Move: Track buys, sells, trades, and income in a spreadsheet or app. Note date, coin, amount, USD value, and fees. I use Google Sheets—free and syncs everywhere. Update it weekly.

- Adopt Tax Software: Try CoinTracker ($59/year, Hobbyist plan) or Koinly ($49/year, Newbie plan). Link Coinbase or MetaMask via API in 10 minutes. Don’t wait for tax season—start now.

- Report Losses Too: Losses offset gains, cutting your tax bill. Lost $2,000 on Shiba Inu? Claim it on Form 8949. I’ve saved clients thousands this way—don’t skip it.

- Check Exchange Data: Binance.US and others issue 1099-MISC or 1099-K forms over $600 in transactions. Verify their numbers; I’ve caught errors like double-counted trades.

- Save for Taxes: Set aside 20–30% of gains in a savings account. After my $800 DeFi profit, I parked $240 at Ally Bank—saved me from a filing crunch.

- Get Expert Help: If your portfolio tops $10,000 or involves DeFi, hire a crypto-savvy CPA. It’s $200–500/hour in Chicago, but beats a $5,000 penalty. Look for IRS Circular 230 compliance.

Why This Hits Home for Me—and Should for You

Last weekend, over a board game at our oak dining table, I watched Julian Jr. laugh and thought about securing his future. Financial missteps, like ignoring crypto taxes, can unravel everything we build for family. I’ve biked along Lake Michigan dreaming of college funds, only to remember clients who lost it all to tax debt. The IRS isn’t just a bureaucracy; it’s a force that can crush anyone, from a Lincoln Park miner to a Loop trader.

Here’s the bottom line: crypto isn’t the Wild West anymore. The IRS has the tech, data, and drive to enforce compliance. Ignoring it isn’t just risky—it’s playing with fire. So, take action today. Log your last five trades, test a tax app, or call a pro. Ready to stay safe? Check your wallet activity this week—don’t wait for Uncle Sam’s letter.

Frequently Asked Questions (FAQs)

Do I report crypto if I didn’t cash out to USD?

Yes. Trading BTC for ETH or buying goods with crypto is taxable. Report gains or losses based on market value at the transaction time, per IRS Notice 2014-21.

What if I lost my crypto records?

Rebuild them using exchange histories (Coinbase, Binance) or blockchain explorers like Etherscan. Without records, the IRS may assume a $0 cost basis, taxing the full sale. Get a tax pro to limit penalties.

Are small crypto amounts taxable?

Absolutely. There’s no minimum. A $10 Dogecoin gain or $5 airdrop must be reported. IRS automation flags even tiny mismatches, so include everything.

Can the IRS track my wallet?

Yes. Via exchange data, blockchain analytics like Chainalysis, and KYC rules, they link wallets to identities. Over 80% of crypto audits start with automated detection, per Treasury reports.