Filing 2025 Taxes as a Freelancer: Your Stress-Free Roadmap

Picture this: it’s late March 2025, and I’m hunched over my desk in Chicago, a cold dark roast Americano by my side, staring at a stack of 1099-NEC forms. As a tax advisor with over a decade of experience, I’ve helped countless freelancers navigate the IRS jungle, but I still get that tiny knot of dread every tax season. What if I miss a deduction? What if a penalty sneaks up on me? If you’re a freelancer, you’ve probably felt this too. Taxes aren’t just numbers—they’re tied to every late-night gig and hard-earned dollar. But here’s the deal: with a clear plan, filing your 2025 taxes can be a breeze. I’m here to walk you through organizing your income, maximizing deductions like the home office credit, and avoiding those pesky IRS penalties. Let’s turn tax season into a win—ready to dive in?

Why Freelancer Taxes Feel Like a Maze

As a freelancer, you’re wearing all the hats—boss, marketer, and, yup, accountant. Unlike W-2 employees who have taxes withheld automatically, you’re responsible for reporting every dime, paying self-employment tax, and filing quarterly estimated taxes. The IRS pegs the number of self-employed Americans at around 16 million as of 2023, a figure that’s only climbed with the gig economy’s rise (IRS.gov). Here in Chicago, I’ve seen freelancers—graphic designers, writers, rideshare drivers—trip over these rules simply because they didn’t realize the IRS sees them as a business.

Your main form? The 1099-NEC (Nonemployee Compensation), issued by clients for payments of $600 or more. No form? You still gotta report that income on Form 1040, Schedule C. I learned this the hard way during a brutal 2012 IRS audit—my toughest life moment—when I almost missed $2,000 because a client skipped the paperwork. Then there’s self-employment tax: 15.3% of net earnings for Social Security and Medicare, with the Social Security portion capped at $168,600 for 2025 (up from $160,200 in 2024, per IRS.gov). It stings, but deductions can help. Let’s break down how to stay on top of it.

Getting Organized: Income and Expenses for Schedule C

Before you file, you need a game plan. I’m a stickler for order—my kids tease me about it during our weekend museum trips in Chicago—but with taxes, it’s a lifesaver. Start by collecting all 1099-NEC forms by January 31, 2025 (clients must send them by then). Missing one? Dig through PayPal, Venmo, or bank statements—those $600+ payments might trigger a 1099-K from processors. I once helped a freelance writer catch a $1,200 Zelle payment by combing bank records. Close call, but we got it.

Next, track expenses. Schedule C lets you deduct “ordinary and necessary” business costs—think internet bills, software like Adobe Creative Cloud ($54.99/month at Best Buy), or a chunk of rent for a home office. Last year, I guided a Chicago graphic designer to claim $3,800 for a MacBook Pro ($1,299 at Apple Store) and coworking fees ($300/month at WeWork). Keep receipts and invoices handy. I use QuickBooks Self-Employed ($15/month, online) to categorize expenses and estimate quarterly taxes. On a budget? An Excel sheet with date, amount, and purpose works too.

Here’s a U.S. quirk: freelancers often hustle while grabbing quick bites at Chipotle. That $10 burrito during a client meet-up? Deduct 50% as a business meal (IRS rules). Small wins add up. And if you’ve seen Black Mirror’s “Nosedive,” you know every transaction leaves a digital trail—even that Starbucks run. The IRS can track it, so report everything.

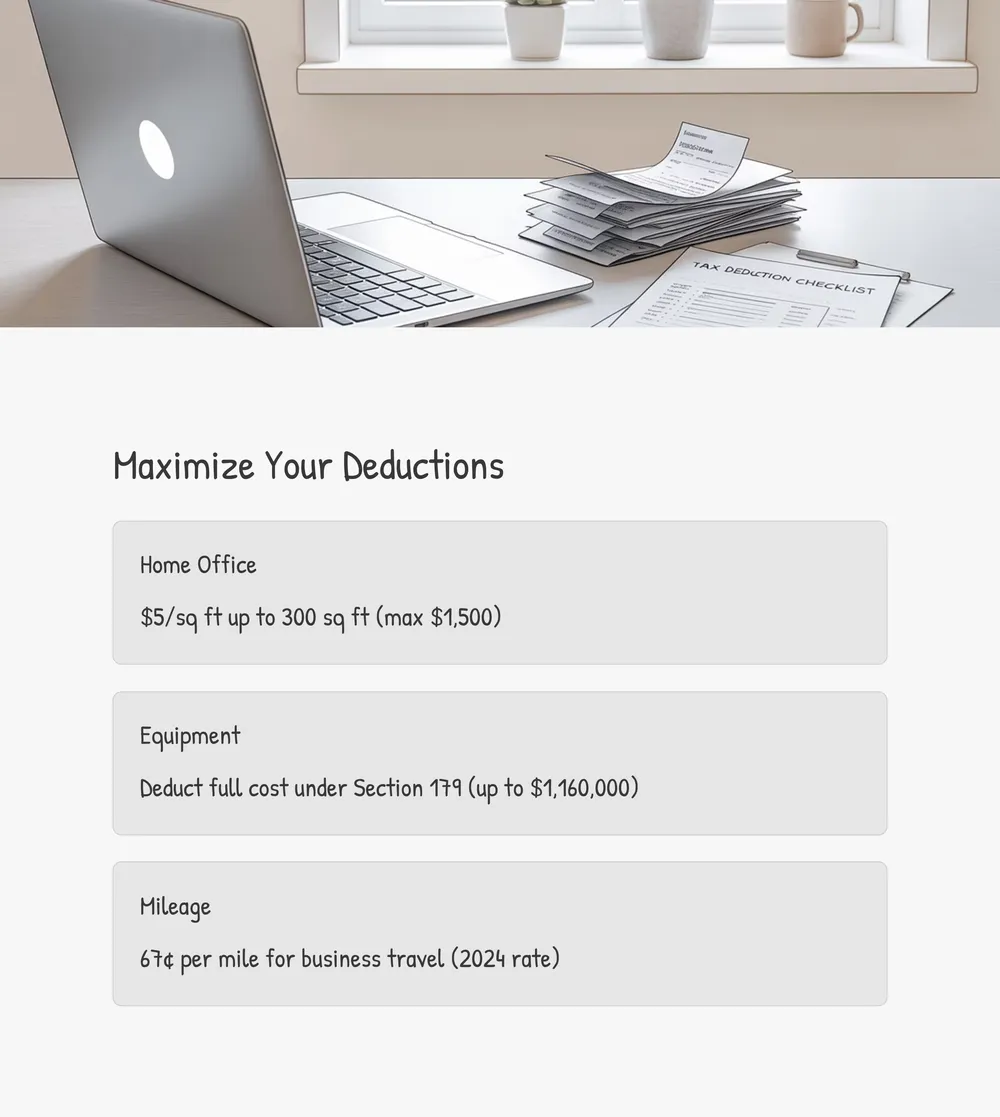

Maximize Your 2025 Deductions Without Breaking a Sweat

Now for the good stuff: deductions. Your mission is to lower taxable income while sticking to IRS rules. The home office deduction is huge—if you’ve got a dedicated workspace, claim $5 per square foot up to 300 square feet (max $1,500) with the simplified method. I’ve used this for my 120-square-foot Chicago office, cutting $600 off my bill last year. Itemizing? Deduct a percentage of rent and utilities based on office size—like 10% for 100 square feet in a 1,000-square-foot apartment. Heads up: it’s more paperwork and an audit risk.

Equipment’s another gem. New laptop for your freelance gig? Deduct the full cost under Section 179, up to $1,160,000 for 2025 (IRS.gov)—most won’t hit that cap. Mileage for business travel (client meetings, deliveries) is also key. The 2024 rate is 67 cents per mile (2025 TBD, IRS.gov). I track mine with MileIQ ($5.99/month, app stores), claiming $1,200 last year for Chicago networking trips. Smaller wins? Professional courses on Udemy ($200) or office supplies from Whole Foods ($15 notebook). Just don’t push it—claiming personal expenses like gym memberships as “productivity” can trigger audits. Play it safe.

Here’s a snapshot of key 2025 deduction limits based on IRS data and projections:

| Deduction Type | 2025 Limit/Rule | Eligibility | Notes |

|---|---|---|---|

| Home Office (Simplified) | $5 per sq. ft., max 300 sq. ft. ($1,500) | Dedicated workspace, regular use | No depreciation needed |

| Equipment (Section 179) | Up to $1,160,000 | Business-use property | Must be purchased |

| Mileage | 67 cents/mile (2024 rate, TBD 2025) | Business travel only | Track with app or logbook |

| Self-Employment Tax Deduction | 50% of 15.3% tax (7.65%) | Net earnings from self-employment | Reduces income tax |

Quarterly Estimated Taxes: Don’t Get Caught Off Guard

Quarterly taxes are a freelancer’s kryptonite. The IRS expects payments on April 15, June 15, September 15, and January 15, 2026, for 2025 taxes if you’ll owe $1,000 or more. Missing them? Penalties hover around 8% annually, compounded daily (IRS.gov). To estimate, take expected income, subtract deductions for net profit, add your tax bracket rate (say, 24% for $95,000 as a single filer), plus 15.3% self-employment tax, then divide by four. I crunch numbers with my CPA buddy Marcus over coffee at a Chicago diner. Last year, I projected $80,000 income, deducted $10,000, and paid $4,500 quarterly at a 25% effective rate. It’s not exact, but it dodges penalties.

Math not your forte? Use IRS Form 1040-ES or their online calculator (IRS.gov). Apps like QuickBooks Self-Employed or TurboTax Self-Employed ($119/year, Intuit.com) help too. Pay via IRS Direct Pay (free) or mail a check. Pro tip from my 2012 audit scare: overpay a bit if unsure. A refund beats a penalty any day—I’ve seen clients save $300 by rounding up $100 per quarter. Gotcha covered?

Your 2025 Filing Checklist: Step by Step

With prep done, filing’s the home stretch. I block a weekend in early April—post-bike ride with my kids—to knock this out. Here’s your 2025 checklist for Form 1040 and Schedule C:

- Complete Schedule C: Report income (1099s, other earnings) in Part I, deductions (e.g., $1,500 home office) in Part II. Net profit goes to Form 1040.

- Calculate Self-Employment Tax: Use Schedule SE. Net profit x 15.3%, deduct half (7.65%) on Form 1040. For $50,000 net, that’s $7,650 total, $3,825 deductible.

- Fill Out Form 1040: Add net profit, other income, subtract deductions/credits. Tax bracket? 24% for singles $95,376–$182,100 (IRS.gov projection).

- Check Credits: Claim Saver’s Credit if you fund an IRA (up to $2,000, singles under $36,500 AGI).

- File Electronically: Use IRS Free File if AGI under $79,000 (IRS.gov) or TurboTax ($89 self-employed, Intuit.com). E-filing cuts errors—I ditched paper after a 2015 mailing delay cost $50.

- Pay Balance: Owe money? Pay by April 15, 2025, via IRS Direct Pay or card (2% fee). Can’t pay? Set up a plan at IRS.gov—interest beats penalties.

This took me 6 hours last year, but software trims it to 3. Overwhelmed? A Chicago tax pro runs $200–$500 for freelancers—worth it if income tops $100,000 or deductions get tricky. Just don’t wait till April 14. Trust me, the stress ain’t worth it.

Crossing the Finish Line—and Looking Ahead

Wrapping up taxes each year feels like a quiet victory—like finishing a marathon. I think of my son, Julian Jr., and how every deduction means more for his future, be it college savings or a family trip. Filing as a freelancer isn’t just numbers; it’s protecting your hard work. If I can bounce back from a panic-inducing 2012 audit, you’ve got this too. And since you’re on top of 2025 taxes, let’s peek ahead. My next guide dives into 2025 student loan forgiveness updates—new rules could save you thousands if you qualify. Stay tuned for tips on applying and maximizing benefits.

Ready to file with confidence? Grab your 1099s this week and test a tracking app like QuickBooks—your future self will thank you. What’s your biggest tax headache as a freelancer? Drop it in the comments; I’m all ears for brainstorming fixes.

Frequently Asked Questions (FAQs)

Do I have to file quarterly taxes as a freelancer in 2025?

Yes, if you expect to owe $1,000 or more for the year. Payments are due April 15, June 15, September 15, and January 15, 2026. Use IRS Form 1040-ES or TurboTax to estimate.

What if I don’t get a 1099-NEC from a client?

You must still report all income, form or not. Check bank statements or apps like PayPal for records, and list it on Schedule C. The IRS can spot unreported income during audits.

Can I deduct my entire rent as a home office expense?

No, only a percentage based on office size (e.g., 10% for 100 sq. ft. in 1,000 sq. ft. home). Or use the simplified method: $5 per sq. ft., max $1,500.

What’s the penalty for missing the tax filing deadline?

For 2025, late filing costs 5% of unpaid taxes per month, up to 25%, plus interest (around 8% annually). File by April 15 or get an extension to dodge the worst fees (IRS.gov).

Let’s make 2025 your easiest tax year yet—start organizing today! What’s your go-to tax hack? Share below, and I’ll chime in with ideas.